Address: 40087 Mission Blvd., Suite 264 Fremont, CA 94539

ESTATE PLANNING

Estate planning

in California

can be as simple as making sure your assets are all kept in joint tenancy, or it may involve more elaborate trust arrangements designed to minimize your estate taxes and guard against your heirs' quickly laying waste to your assets. A good estate plan not only makes use of documents like wills and trusts to accomplish your purposes but also has room for powers of attorney and living wills to handle periods of incapacity. It also takes into account the final processing of your affairs, also known as the probate process.

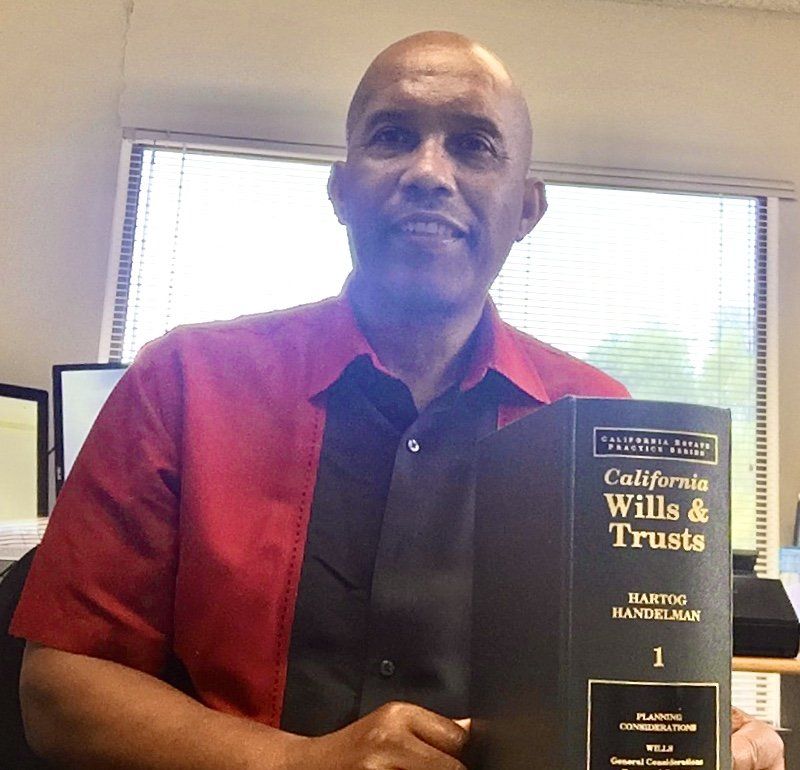

At the Law Office of Raymond Churchill, Attorney at Law, We Can Help You with Whatever Estate Planning or Elder Care Problem You Have.

Whether you need to protect your assets as a spouse goes to live in a nursing home now or whether you are planning for a myriad of possibilities down the road, we have the skills that you need to ask the right questions and help you reach the right answers.

We provide counseling in areas of: (Click Box to learn more.)

Trusts

– Trusts have come a long way. People used to think of a Trust as just a way for the wealthy to keep a firm hand on their children and children's' children. Today, trusts provide average families with the opportunity to pre-plan for the handling of their assets not just once they've died, as a will does, but while they're alive, too. A trust can still be used to remove money from an estate for tax purposes, but it can be used to:

- Address special needs - a trust can be designed to provide for the needs of family members with physical or mental disabilities

- Ensure a business remains viable - a trust can provide detailed instructions to continue operation of a family business to benefit your spouse and children by designating a more qualified person to handle the business decisions if your family members aren't suited for the task

- Elimination of probate - since trusts can own property, any assets transferred to a trust during your life do not necessarily need to go through probate to be distributed to a new owner at your death, eliminating the cost for court costs and attorney’s fees

Since you have a universe of possibilities to you in drafting a trust, you can also create trusts that allow you to serve as trustee and provide for a transition to another trustee during periods of incompetence or disability.

Wills

- Having a will is one of the easiest parts of an estate plan to put together. Without a will, you have no control over many things including

- Who has the responsibility for collecting your assets, paying your bills and handling the remainder

- Who gets custody of minor children or

- How money is accessed for your children and spouse's welfare.

A will allows you the flexibility not only to see that people beyond your legal heirs receive your property, but also gives you the change to place limits on its use or restrict spending.

Probate & Trust Administration

- Almost all estates require some administration, even if it involves something as simple as paying outstanding medical and funeral bills and transferring property out of a trust. Not all estates, however, require probate. Probate is the process of following through with the wishes expressed through a will, or arranging for the disposition of property for someone who had no will. The process is significant because it is done under the watchful eye of a probate court. When a loved one dies, and they have a trust, the process of trust administration will need to be undertaken. Some administrative duties and expenses revolve around trust administration that families and Trustees need to understand.

If you have been left with the task of winding up the affairs of a loved one who has recently died, we can help guide you through what the law requires so that nothing is overlooked.

Medi-Cal Planning

- We help individuals qualify for the Medi-Cal “Long Term Care”

program and protect their assets. We specialize in Medi-Cal planning and asset protection for those family members who are entering the “Golden Years” of their lives. With our help, the majority of those who consult with us can qualify for Long Term Care and legally preserve a significant portion of their assets.

We can help you minimize the “share of the cost,” and often use techniques allowing you to direct your share of the cost to a spouse. We can also often help avoid recovery claims by the State.

With our assistance, the majority of those who consult with us can qualify for Long Term Care Medi-Cal, legally preserving most, if not all, of their assets for themselves and their loved ones.

Contact Information

Phone:

(510) 490-3810

Fax:

(510) 490-3811

Email:

ray@raychurchill.com

Address:

40087 Mission Blvd., Suite 264

Fremont, CA 94539

Business Hours:

- Mon - Fri

- -

- Sat - Sun

- Appointment Only

Evenings and Weekends By Appointment

Content, including images, displayed on this website is protected by copyright laws. Downloading, republication, retransmission or reproduction of content on this website is strictly prohibited. Terms of Use

| Privacy Policy